PERS Plan 3

Public Employees’ Retirement System (PERS) Plan 3 is a 401(a) plan with two parts: pension and investment. Your employer contributes to your pension, and you contribute to the investment account. When you meet plan requirements and retire, you are guaranteed a monthly benefit for the rest of your life from the employer-funded pension. With the investment part, you choose when to begin withdrawing funds, which can be any time after you separate employment.

You contribute between 5% and 15% of your wages to your investment account. You select this percentage when you begin employment.

More about Plan 3 contribution rates

Member contribution rate options

Option A 5% all ages

Option B 5% up to age 35 6% ages 35 through 44 7.5% ages 45 and older

Option C 6% up to age 35 7.5% ages 35 through 44 8.5% ages 45 and older

Option D 7% all ages

Option E 10% all ages

Option F 15% all ages

If you don’t choose a contribution rate, your withholding will default to Option A. Once your rate is set, you can change it only when you change Plan 3-covered employers. Changing means working for a different employer, not another division or department within your current workplace. More about contributions.

Investment Account Customer Service by Voya Financial

Voya Financial is the DRS record keeper for DCP, Plan 3 and JRA customer investment accounts. They can assist you with transactional needs and account information.

Call Voya: 888-327-5596 (TTY users dial 711)

Fax: 844-449-2551

Chat live with customer service when you select the chat icon from the Voya login page (you can also chat once you are logged into your investment account).

Mailing address:

Voya Financial

Attn: Washington State DRS

PO Box 389

Hartford, CT 06141

What does the record keeper do?

The DRS record keeper maintains the records for Plan 3, DCP and JRA customer investment accounts and assists customers with transactions related to these accounts.

See a live or recorded Plan 3 webinar.

How much will your pension retirement be?

Estimate your retirement benefit in minutes using the personalized Benefit Estimator in your online account. Your total pension amount is based on your years of service and your income. See more about how we calculate your benefit.

How to estimate your benefit

- From the DRS homepage, select the Member Login button in the top right.

- Log in to your online account.

- In the menu bar, select your plan name – such as PERS 2. This will open a dropdown menu.

- Select Benefit Estimator.

- Read how to use the estimator and select Accept & Continue.

- For first-time users, we recommend using the four-step process. This helps you learn how your benefit is calculated.

You can use this tool at any point in your career. You can create an estimate using different factors as many times as you like. This calculator will allow you to see a private preview of what your monthly retirement income might look like.

Years of service

Your service credit is the number of years you work in public service. You receive one service credit each calendar month in which you are compensated for 90 or more hours of work. You can earn no more than one month of service credit each calendar month, even if more than one employer is reporting hours you work. You receive one-half of a service credit if you work fewer than 90 hours but at least 70 hours in a calendar month. You receive one-quarter of a service credit if you are compensated for fewer than 70 hours in a calendar month. Review your service credit detail through your online account.

Your income

The Average Final Compensation, or AFC is the average of your 60 consecutive highest earning months in your career. This could be at the beginning, middle or end of your career. DRS uses your AFC income information to calculate your pension amount. For high income public employees, federal law limits the amount you can contribute toward retirement and limits the benefit calculation. See IRS limits.

PERS Plan 3 pension formula

1% x service credit years x Average Final Compensation = monthly benefit

Example:

Let’s say you work 23 years and the average of your highest 60 months of income (AFC) is $5,400 per month.

1% x 23 years x $5,400 = $1,242

When you retire, you’d receive $1,242 per month in pension income. Remember, your investment income is calculated separately

How much will your investment retirement be?

The total amount available from your investment account in retirement will depend on a few things.

- The income percentage you chose (or defaulted into) when you selected the plan

- Your income and years of contributions

- Investment selection and performance

Get a complete picture of your projected retirement income through your investment account. Here you can add your Plan 3 pension and investment income, social security, and any additional retirement savings such as DCP.

When can you retire?

Now that we’ve discussed how much money you can get in retirement, let’s talk about when you can retire. You are eligible for a pension retirement when you are vested, which happens when you have achieved one of the following:

- 10 service credit years

- Five years of service credit with at least 12 months earned after age 44

- Five service credit years earned in PERS Plan 2 before June 1, 2003

Full retirement

Full retirement is the earliest age you can retire without any reduction to your retirement benefit. PERS Plan 3 members are eligible to retire at age 65 if they are vested.

Early retirement

You can withdraw from your investment account at any time after separating employment. For your employer-funded pension plan, specific rules apply for when you can retire. You can retire as early as age 55 with a reduced benefit if you have at least 10 service credit years.

Early retirement – Joined before May 1, 2013

If you retire before age 65, it’s considered an early retirement. If you have at least 10 years of service credit and are 55 or older, you can choose to retire early, but your benefit will be reduced. There is less of a reduction (in some cases no reduction) if you have 30 or more years of service credit.

If you have 30 or more years of service and you are age 62, you can retire with a full benefit under the 2008 ERF.

How does retiring early affect my monthly benefit?

When you retire early, your monthly benefit amount is reduced to reflect that you will be receiving your pension payments for a longer period of time. The amount of the impact depends on the amount of service credit you have, the date you retire and your age. (See “Early retirement benefit formulas” below.)

If you retire early with 10 – 30 years of service credit, your monthly benefit is reduced by a factor that is based on your average life expectancy. Early retirement factors are subject to change based on State Actuary figures. The reduction is greater than if you retire with at least 30 service credit years.

Early retirement factors

Actuarial early retirement factors, for those with less than 30 years of service, vary by system and plan and are updated at least every six years. See current early retirement factors for Plan 2 members with at least 20 years or Plan 3 members with at least 10 years of service.

- Plan 2: Need at least 20 years of service credit to qualify

- Plan 3: Need at least 10 years of service credit to qualify

Early retirement factors for less than 30 years of service

| Retirement age | Factor |

|---|---|

| 55 | 0.4092 |

| 56 | 0.4450 |

| 57 | 0.4844 |

| 58 | 0.5280 |

| 59 | 0.5760 |

| 60 | 0.6292 |

| 61 | 0.6882 |

| 62 | 0.7538 |

| 63 | 0.8269 |

| 64 | 0.9085 |

Early retirement factors for 30 or more years of service

| Retirement Age | 2008 ERF |

|---|---|

| 55 | 0.80 |

| 56 | 0.83 |

| 57 | 0.86 |

| 58 | 0.89 |

| 59 | 0.92 |

| 60 | 0.95 |

| 61 | 0.98 |

| 62 | 1.00 |

| 63 | 1.00 |

| 64 | 1.00 |

If I retire early, what reductions will apply?

The amount of the reduction to your monthly benefit depends on how much younger than age 65 you are when you retire and the amount of service credit you have. This reduction reflects that you will be receiving your defined benefit for a longer period of time than if you had retired at age 65. Consider how the ERFs are applied in the early-retirement examples shown below.

For more information on early retirement, read Washington Administrative Code 415-02-320.

Plan 3 early-retirement formula

1% x service credit years x Average Final Compensation (AFC) x ERF = monthly benefit

Returning to work could affect your retirement income. See working after retirement.

Early retirement examples

How much difference can early retirement make? That depends on your circumstances, including your wages and age at retirement. Consider the examples below. The administrative factors used in these examples are for illustrative purposes only.

Example 1: Fewer than 30 years

Customer retires Sept. 1, at age 55 with 22 years of service credit.

Their AFC is $3,600. They are retiring early, so using the administrative factor (above table) the monthly benefit is 40.92% of what it would have been at age 65, calculated as follows:

= 1% x 22 years x $3,600 x 40.92%

= 0.01 x 22 x $3,600 x 0.4092

= $324.08 per month

Example 2: 30 or more years

Customer retires April 1, at age 60 with 30 years of service credit using the 2008 ERF.

If they choose to retire under the 2008 ERF, their benefit is reduced by 5% (due to age). The 2008 ERF monthly benefit would be calculated as follows:

= 1% x 30 years x $4,400 x 95%

= 0.01 x 30 x $4,400 x 0.95

= $1,254

Early retirement – Joined on or after May 1, 2013

If you retire before age 65, it’s considered an early retirement. If you have at least 10 years of service credit and are 55 or older, you can choose to retire early, but your benefit will be reduced. There is less of a reduction if you have 30 or more years of service credit.

If you were hired on or after May 1, 2013 and retire early (age 55-64) with 30 years of service credit, your benefit will be reduced by 5% for each year (prorated monthly) before you turn age 65.

How does retiring early affect my monthly benefit?

When you retire early, your monthly benefit amount is reduced to reflect that you will be receiving your pension payments for a longer period of time. The amount of the impact depends on the amount of service credit you have, the date you retire and your age. (See “Early retirement benefit formulas” below.)

If you retire early with 10 – 30 years of service credit, your monthly benefit is reduced by a factor that is based on your average life expectancy. Early retirement factors are subject to change based on State Actuary figures. The reduction is greater than if you retire with at least 30 service credit years.

Early retirement factors

Actuarial early retirement factors, for those with less than 30 years of service, vary by system and plan and are updated at least every six years. See current early retirement factors for Plan 2 members with at least 20 years or Plan 3 members with at least 10 years of service.

- Plan 2: Need at least 20 years of service credit to qualify

- Plan 3: Need at least 10 years of service credit to qualify

Early retirement factors for less than 30 years of service

| Retirement age | Factor |

|---|---|

| 55 | 0.4092 |

| 56 | 0.4450 |

| 57 | 0.4844 |

| 58 | 0.5280 |

| 59 | 0.5760 |

| 60 | 0.6292 |

| 61 | 0.6882 |

| 62 | 0.7538 |

| 63 | 0.8269 |

| 64 | 0.9085 |

Early retirement factors for 30 or more years of service

| 5% ERF | |

|---|---|

| 55 | 0.50 |

| 56 | 0.55 |

| 57 | 0.60 |

| 58 | 0.65 |

| 59 | 0.70 |

| 60 | 0.75 |

| 61 | 0.80 |

| 62 | 0.85 |

| 63 | 0.90 |

| 64 | 0.95 |

If I retire early, what reductions will apply?

The amount of the reduction to your monthly benefit depends on how much younger than age 65 you are when you retire and the amount of service credit you have. This reduction reflects that you will be receiving your defined benefit for a longer period of time than if you had retired at age 65. Consider how the ERFs are applied in the early-retirement examples shown below.

For more information on early retirement, read Washington Administrative Code 415-02-320.

Plan 3 early-retirement formula

1% x service credit years x Average Final Compensation (AFC) x ERF = monthly benefit

Returning to work could affect your retirement income. See working after retirement.

Early retirement examples

How much difference can early retirement make? That depends on your circumstances, including your wages and age at retirement. Consider the examples below. The administrative factors used in these examples are for illustrative purposes only.

Example 1: Fewer than 30 years

Customer retires Sept. 1, at age 55 with 22 years of service credit.

Their AFC is $3,600. They are retiring early, so using the administrative factor (above table) the monthly benefit is 40.92% of what it would have been at age 65, calculated as follows:

= 1% x 22 years x $3,600 x 40.92%

= 0.01 x 22 x $3,600 x 0.4092

= $324.08 per month

Example 2: 30 or more years

Customer retires April 1, at age 62 with 30 years of service credit using the 5% ERF.

If they choose to retire under the 5% ERF, their benefit is reduced 5% for each year before age 65. In this case, they are retiring 3 years early, so 5% three times equals a 15% reduction from 100% (so 85%). The 5% ERF monthly benefit would be calculated as follows:

= 1% x 30 years x $4,400 x 85%

= 0.01 x 30 x $4,400 x 0.85

= $1,122

See a live or recorded early retirement webinar.

Considering delaying your retirement? This short delayed retirement video offers some tips and information.

How do you retire?

Plan 3 member, you have two money sources to use toward retirement – an employer funded pension, and an investment account you fund. You must meet service requirements to be eligible for the employer-funded pension. But once you meet those, you are guaranteed a lifetime pension income.

Pension

How to retire with DRS: Pension

When you are within 12 months of retiring, you can start the official retirement process with DRS. First, you request an official benefit estimate. Once you receive the estimate, you complete and submit your application to retire. See this steps to retire with a pension video.

1. Request an official benefit estimate from DRS 3 to 12 months prior to your retirement date. Make this request through your online account or by contacting us. In most cases, we will provide your estimate 5 to 8 weeks before your retirement date. If you haven’t received your requested estimate within 5 weeks of your retirement date, contact us.

Estimates are prioritized by retirement date, which allows DRS to use the most recent information available for you and gives you ample time to submit your retirement application. An official benefit estimate is not the same as the benefit estimator tool available to all customers. To assist your retirement planning any time before or after requesting your official benefit, you can use the benefit estimator tool through your online account.

2. Apply for retirement through your online account. After receiving your official benefit estimate, we recommend completing the application at least 3 to 5 weeks before the date you intend to retire. If you can’t make this timeline, contact us as soon as possible so we can help keep your retirement on track. Members of more than one system will need to complete a paper application.

Estimate your retirement pension income

You can use the benefit estimator tool in your online account to help plan for retirement at any point—while you are still working, and even after you submit an official request to retire. Log into your online account and select the benefit estimator tool to get started.

Plan 3 investment withdrawals

How to withdraw your Plan 3 investments

At any point after you separate from employment, you can begin withdrawing your Plan 3 investment contributions.

To complete your withdrawal online, log into your online account and select your Plan 3 investment account. Under the “More resources” menu, select Request online withdrawal.

Your Plan 3 investment account offers several options for withdrawals. Receive one-time or regular payments in an amount and frequency you choose. Purchase an annuity such as the Plan 3 TAP annuity. Roll your Plan 3 contributions into another eligible employer plan. You can also leave your Plan 3 savings invested for as long as you want even if you separate from Plan 3-covered employment.

You can also contact the DRS record keeper, Voya financial at 888- 327-5596 for assistance with your investment transaction. Or log into your Plan 3 investment account to chat live with a customer service associate. They will help you select the right transaction for your needs.

The amount of time it takes to receive your investment withdrawal depends on where your contributions are invested. See the next section for more information.

What if you separate before retirement?

As a Plan 3 member, you can withdraw your contributions and investment earnings from your investment account at any time after you leave your plan-covered employment. However, if you do, you could reduce an important source of your retirement income.

You made your Plan 3 contributions before the income was taxed. There are tax implications to withdrawing your contributions, so you might want to contact the IRS or a tax advisor before making a decision.

The IRS requires that you begin taking payment of your monthly benefit by the time you are 73, unless you are still employed.

Be sure to keep us up to date on any changes to your name, address or beneficiary. It’s important that you keep your beneficiary designation current. A divorce, marriage or other circumstance might invalidate it.

For more information about your options when separating, see this short career transitions video.

Service credit is cumulative

The service credit you earn toward vesting is cumulative. This means if you separate but later return to public service, you can continue to earn service credit toward your vested status even if you didn’t yet qualify when you separated. For Plan 1 and Plan 2 members, withdrawing your contributions when you separate will set your service credit years to 0.

Plan 3 pension increases

If you have at least 20 years of service credit when you leave employment and do not start to receive your pension, it will increase by approximately 3% for each year you delay receiving it up to age 65 (this is called indexing and is exclusively available to Plan 3).

When do you get paid?

Pension payments

Your pension money will be deposited into your bank account on the last business day of the month, every month, for the rest of your life. The retirement application has a section for your bank information so your funds will be deposited. Once you’ve retired, you can make any updates to your direct deposit through your online account.

Investment withdrawals

The time it takes to begin receiving your investment withdrawals depends on two things:

- Do you have contributions in the WSIB TAP fund?

- Has your employer reported your separation to DRS?

WSIB TAP investment withdrawals

The investment portion (defined contribution) you pay into has investment shares with valuation time periods that vary by the investment program you selected. If you’ve already left service and your employer has electronically uploaded your separation date, the following timelines will apply. It could take an additional 30 days beyond the timeframes given below if your employer hasn’t reported your separation to DRS. Plan 3 members have two investment programs to choose from and you can transfer your contributions from one fund to the other.

Most WSIB Investment Program TAP Fund withdrawals take 6-8 weeks

If your funds were invested in the WSIB TAP fund, you should expect to receive them 6-8 weeks after your request. Your request for payment and separation date from your employer must be received by the third to last business day of the month to meet the cutoff for the monthly pricing the following month, with payment being made at the start of the month after that.

| Request month | TAP value calculated | Payment issued |

|---|---|---|

| January | February | March |

| February | March | April |

| March | April | May |

| April | May | June |

| May | June | July |

| June | July | August |

| July | August | September |

| August | September | October |

| September | October | November |

| October | November | December |

| November | December | January |

| December | January | February |

| Your request and separation must be received by DRS before the third to last business day. If either comes later, use the next month as your request month. | This value is calculated on the 10th business day. | You'll receive payment about a week into the month. |

Example

A January request must be made before the third to last business day. If your separation information or request are submitted to DRS later, consider February as your request month.

For a January request, the TAP value is calculated on the 10th business day of February. You will receive your payment about a week into March.

Why is the WSIB TAP fund calculated monthly?

The fund contains slower moving assets, such as real estate. These assets increase the total diversity of the fund, but it takes more time to assess the value.

Under certain emergency conditions, you can expedite the timing of this withdrawal. Contact the record keeper to find out more 888-327-5596.

All other Plan 3 Investment withdrawals

If you’ve already left service and your employer has provided your separation date, the following timeline will apply. It could take an additional 30 days beyond the timeframes given below if your employer hasn’t reported your separation to DRS.

Most Plan 3 investment withdrawals take 1 to 31 business days For lump-sum payments, investment shares are redeemed daily. If your documents are accepted in good order by 1 pm Pacific Time, your payment is issued the next business day. For scheduled payments, investment shares are redeemed between the first and 27th of every month, and payments are issued on the first or 15th of each month.

How is my withdrawal taxed?

You will pay federal income tax for withdrawals from both your Plan 3 pension and investment accounts. The withdrawal request you complete will include tax information specific to your withdrawal type. Here is some general information about withdrawals.

Investment withdrawals (your contributions)

If you choose a direct rollover, except for a Roth IRA, you are not taxed until you later take payment out of the traditional IRA or the eligible employer plan. Taxes will continue to be deferred.

The IRS requires a 20% tax withholding on any lump-sum withdrawal or if your installment payment plan is expected to last less than 10 years. This means that if you decide to withdraw $10,000 all at once, you will be sent a check for $8,000. The remaining $2,000 will be sent to the IRS. If your installment payments will last longer, you might decide what you would like withheld by completing a form IRS W-4P.

If you receive a payment before you reach age 59½, and you do not roll over your defined contribution funds, you might have to pay an additional tax equal to 10% of the taxable portion of the payment when you file your taxes. Visit the IRS website for more information. If you complete your investment account withdrawal online, you’ll also receive a real-time estimate of your tax withholding. For tax advice, you should consult an accountant, qualified financial advisor, or the Internal Revenue Service.

IRS tax exclusion timing

If contributions to your pension plan were previously taxed, the IRS requires a tax exclusion to the payment you take first: your pension or a withdrawal from your investment contributions. This is sometimes called basis recovery. It prevents you from being taxed again on those contributions. If the exclusion occurs on your pension payment, you will see the amount on your 1099-R in box 5a. It will end once you receive an exclusion equal to the taxed contribution amount. The IRS determines the calculation used for this process.

Pension benefit (employer contributions)

Your monthly pension payments will have standard income tax deducted. We do not deduct any individual state tax, no matter where you live.

For more information about withdrawing from your Plan 3 investment account, contact the DRS record keeper.

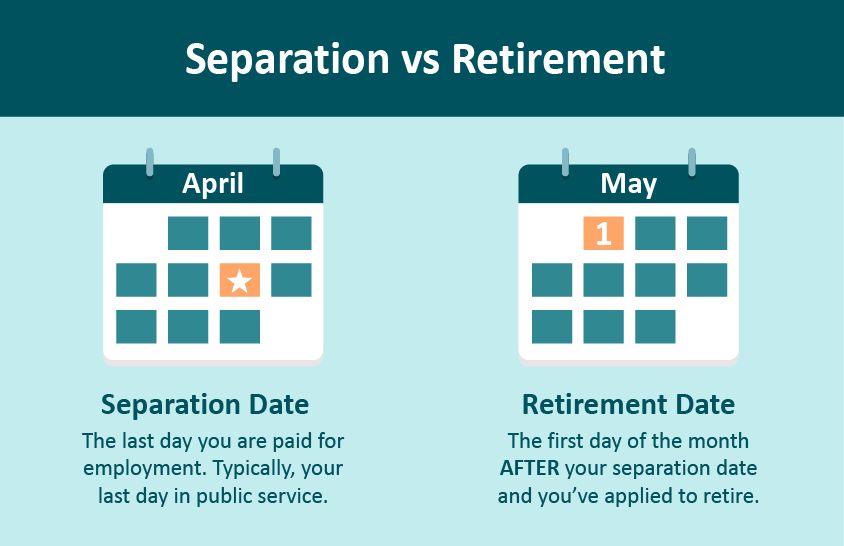

Separation vs retirement

You are retired from DRS when you separate from employment and begin collecting your pension. If you leave public employment, but you are not yet collecting a pension, we consider you separated, but not retired. These instructions assume you are separating and will be collecting your pension (retiring).

See live or recorded retirement planning webinars.

How can you increase your pension amount?

You can increase your pension benefit by increasing your years of service or your income. But when it comes to total retirement income, you have more options.

DCP savings program

The Deferred Compensation Program or DCP is a voluntary savings program you can use to increase your retirement savings. DCP uses many of the same investment options available to Plan 3 members, including investments that are managed for you. With DCP, you control your contribution amount so your savings can grow with you. Saving an additional $100 a month now could mean an extra $100,000 in retirement!

(Example based on 6% annual rate of return over 30 years of contributions.) More about DCP.

Plan 3 benefit indexing

Benefit indexing is a form of pension inflation protection you may automatically qualify for when you separate from service. Eligibility for benefit indexing requires you to:

- Be in Plan 3

- Have at least 20 service credit years before you stop working

- Separate before reaching normal retirement and delay receiving your pension benefit

For every month you delay collecting your pension, your benefit amount will be increased by 0.25% (or 3% annually). Benefit indexing stops once you retire or reach your normal retirement age. Once you retire, you’ll instead be eligible to receive an annual maximum 3% COLA.

Benefit indexing example

Francis is a Plan 3 member who is 64 years old, with 20 service years and an average monthly salary of $5,000.

Their Plan 3 benefit calculation is: 1% x 20 years x $5,000. This would provide Francis with $1,000 per month.

In addition to a monthly pension, Francis also has an investment account to draw from in retirement.

Francis also has the option to stop working prior to age 65 but choose not to receive a pension benefit until their first eligible unreduced date of age 65. During that time, their pension will grow. Here are two scenarios of how that could look:

Scenario 1: Stop working at age 64

Start collecting a pension at age 65

The pension benefit increases about 3% in one year (.25 x 12 months = 3)

The pension is $1,030/month

Scenario 2: Stop working at age 65

Start collecting a pension at age 65

The pension benefit calculations is: 1% x 21 years of service x $5,000

The pension is $1,050/month

Annuity options

What is an annuity?

Annuities are lifetime income plans you purchase.

When it’s time to retire, you have some additional options—options that can change your finite savings into a monthly, lifetime income called an annuity. An annuity is a guaranteed income plan you purchase. The monthly payments you receive are based on the dollar amount you choose to purchase. The annuity will provide monthly payments for your lifetime. The annuities DRS offers are administered by Washington state with investments provided by the Washington State Investment Board.

Is an annuity right for me?

Annuities can provide guaranteed income for your life. And they offer security through a set monthly income which can increase annually if you are eligible for a Cost-of-Living Adjustment (COLA). However, flexibility is not a feature of annuities. Once you set it up, an annuity doesn’t allow you to change the income amount. Once you begin receiving monthly payments, you cannot cancel the annuity.

With annuities, you take money out of market risk and use it to give yourself a monthly lifetime income. Annuities are the only investment withdrawal option that guarantee you will not outlive your account balance.

How do annuities affect my taxes?

Each year you’ll receive a statement that shows the taxable amount of your annuity. DRS is required to withhold a certain amount of federal taxes. If you would like more tax withheld, complete a W-4P form. Without a W-4P, the tax withholding will follow IRS guidelines, using a filing status of single with no adjustments.

For more information about taxes, review IRS Publication 575. You might want to consult a tax advisor when considering purchasing an annuity. DRS and the record keeper are not authorized to give tax advice.

Considering an annuity?

If you are considering purchasing an annuity offered through your plan, be sure to let us know when you request your official retirement estimate. This will allow us to include an annuity estimate along with your retirement estimate.

PERS Plan annuity

This annuity is available to all PERS, SERS and PSERS retirement plan members. With this annuity, your survivor will be the same as the one you selected for your pension payment. You can use your DCP savings to purchase this annuity in addition to other approved funding sources. If you return to work, this annuity continues.

More about PERS plan annuity

When can I purchase?

When you are retiring.

Are there limits to the annuity amount I can purchase?

Yes, the minimum purchase amount is $5,000. There are no maximum limits.

How much does it cost?

Log in to your account and choose “Purchasing Annuity.” Here you can find the monthly increase to your pension for any purchase amount.

What funds can I use to purchase an annuity?

Your payment must come from an eligible governmental plan, like your pretax DCP savings. Members cannot use PERS/SERS/TRS Plan 3 contributions to pay for this annuity.

When does my annuity benefit begin?

Your retirement date or the day after your bill for the annuity is paid in full, whichever comes later.

How often do I receive my annuity benefit?

Monthly.

Can I designate a survivor?

Yes. Your survivor must be the same survivor and survivor option you chose for your retirement benefit.

Will I receive a Cost-of-Living Adjustment (COLA)?

Yes. You will receive a COLA up to 3% annually. If you’re a Plan 1 member, a COLA is optional at retirement and your choice will also apply to this annuity purchase.

How do I purchase this annuity?

Request this annuity when you retire online. You can also purchase it when completing a paper retirement application.

Can I cancel the annuity if I change my mind?

In most cases, no. Annuities are fixed income sources. Once you purchase the annuity, you will not have access to the funds you used to make the purchase.

There are two exceptions:

If you have not completed the annuity purchase, you can still change or cancel the annuity.

Once you make the purchase, you’ll have 15 days to cancel the transaction. You’ll receive a mailed contract that includes your rescission, or cancel by date.

Will my annuity purchase be refunded if I die?

If you (and your survivor if you selected a survivor option) die before the amount of your annuity purchase has been paid back to you, the difference will be refunded to your beneficiary.

What if I return to work?

Your annuity continues.

Purchase service credit

Purchasing additional service credit increases your monthly retirement benefit for the rest of your life. You can purchase between one and 60 months of service credit in whole months. Purchasing service credit will increase your monthly benefit, but it will not increase the years of service posted on your account. The increase to your benefit is calculated using the same formula as your retirement benefit. This additional service credit is available at the time of your retirement only. Also, you cannot use the additional credit to qualify for retirement (it won’t increase your years of service).

More about the service credit annuity

When can I purchase?

When you are retiring.

Are there limits to the amount of service credit I can purchase?

Minimum: One month; Maximum: 60 months.

How much does it cost?

Log in to your account and choose “Purchasing Service.” Here you can find the estimated cost and income increase per month you purchase.

What funds can I use to purchase service credit?

You can use any funds except for Plan 3 contributions. Funds rolled over from your DCP account must be pretax.

When does my annuity benefit begin?

After you have made payment in full.

How often do I receive the benefit?

Monthly.

Can I designate a survivor?

Yes. Your survivor will be the same option you chose for your retirement benefit.

Will I receive a Cost-of-Living Adjustment (COLA)?

Yes. You will receive a COLA up to 3% annually. If you’re a TRS Plan 1 or PERS Plan 1 member, a COLA is an optional choice at retirement.

Can I cancel the annuity if I change my mind?

No. Annuities are fixed income sources. Once you purchase the annuity, you will not have access to the funds you used to make the purchase. If you have not completed the annuity purchase, you can still change or cancel the annuity.

How do I purchase service credit?

Request this annuity when you retire online. You can also purchase it when completing a paper retirement application.

Will my annuity purchase be refunded when I die?

Yes. If you (and your survivor if you selected a survivor option) die before the amount of your purchase has been paid back to you, the difference will be refunded to your beneficiary. For TRS Plan 1, this refund does not apply if you selected the Maximum Option.

What if I return to work?

The return to work rules for service credit are the same as your retirement benefit. If you return to work for a DRS-covered employer, your annuity will stop if you return to retirement system membership or if you exceed allowable hours as a retiree (867 per year). If you do not return to a DRS-covered employer, your annuity will continue.

When will my benefit increase be effective?

The increase in your benefit will be effective the day after the department receives your full payment.

Plan 3 TAP Annuity

Plan 3 members can use their plan contributions to purchase the Total Allocation Portfolio (TAP) Annuity. With the TAP Annuity, you are not limited to the survivor options you chose for your pension retirement. You can choose another survivor. You can also purchase the TAP Annuity any time after you separate from DRS-covered employment.

It can take 45 to 90 days to receive your first TAP Annuity payment. See the payment section below for a timeline of the purchase process. For information about the status of your annuity purchase, contact the DRS record keeper.

More about the Plan 3 TAP Annuity

When can I purchase?

When DRS receives your separation date, or any time after.

Are there limits to the annuity amount I can purchase?

Minimum: $25,000; Maximum: Your total Plan 3 investment account balance.

How much does it cost?

Use the TAP Annuity Estimator calculator or contact the Plan 3 record keeper.

What funds can I use to purchase the annuity?

Contributions from your Plan 3 investment account. To purchase the annuity using funds from both your WSIB and Self-Directed investment programs, you’ll need to transfer the funds to either the WSIB program or the Self-Directed Investment Program first.

How often do I receive my annuity benefit?

Monthly.

Can I designate a survivor?

Yes.

Can I cancel the annuity if I change my mind?

In most cases, no. Annuities are fixed income sources. Once you purchase the annuity, you will not have access to the funds you used to make the purchase.

There are two exceptions:

- If you have not completed the annuity purchase, you can still change or cancel the annuity.

- Once you make the purchase, you’ll have 15 days to cancel the transaction. You’ll receive a mailed letter that includes your rescission, or cancel by date.

How do I purchase an annuity?

Complete the purchase online or call the Plan 3 record keeper at 888-327-5596 for assistance.

Will I receive a Cost-of-Living Adjustment (COLA)?

Yes. Your TAP annuity will receive an automatic COLA of 3% annually. This COLA is applied on the anniversary of the annuity.

Will my annuity purchase be refunded when I die?

If you (and your survivor if you selected a survivor option) die before the amount of your annuity purchase has been paid back to you, the difference will be refunded to your beneficiary.

What if I return to work?

Your annuity continues.

Can I buy more than one TAP Annuity?

No. You can buy only one TAP Annuity.

What else should I know?

You don’t need to be separated to move money into the TAP investment program, only to purchase the TAP Annuity.

You can purchase the TAP Annuity and start receiving monthly payments at any age.

You can purchase the TAP Annuity anytime you qualify to receive a distribution—between employment opportunities, at retirement or any time after retirement.

You can only purchase the TAP Annuity one time per retirement system membership (one each for PERS, SERS or TRS accounts).

The 3% Cost-of-Living increase (COLA) will be added to your payment each year on the anniversary of your annuity purchase.

How can I find out more?

Contact the Plan 3 record keeper for assistance.

How can I get assistance with my account once I purchase the TAP annuity?

To update your withholding, beneficiary information, direct deposit or for other inquiries, TAP annuitants can contact the DRS record keeper, Voya Financial for assistance.

When do I receive my first TAP Annuity payment?

How long does it take?

About two months. Your first payment could take anywhere from 45 to 90 days. The most common timeline is about two months. The timeline includes DRS receiving your request and a separation date from your employer. Your employer usually sends your separation date with your final contributions to DRS after you receive your final paycheck—that could take up to 45 days depending on your employer’s reporting process.

Why does it take this long?

The price for the WSIB TAP fund is calculated each month, after the end of the month. When you request to purchase a TAP Annuity, it can take two or more months to know the value and have the final reporting from your employer.

Example: TAP Purchase timeline

1 Request and separation

July 9 – The customer separates employment and completes TAP Annuity purchase request.

July 26 – DRS receives a separation date from the employer.

2 Price and purchase

Aug. 13 – The TAP valuation from July is applied to calculate the value of the TAP shares.

Aug. 30 – An annuity contract is created on the 2nd to last business day of the month and sent to the customer. They will have 15 days to rescind the contract.

3 Contract and payment

Sept. 3-10 – The first TAP Annuity payment is issued to the customer. Depending on the form of payment (paper check or direct deposit), the customer receives the payment between the third and tenth of September, and will receive payments on or around the same day each month.

Why is my separation date important?

If the DRS record keeper has not received completed paperwork from the customer or the employer has not sent the separation date by the third to last business day of the month, it could add an additional month to the purchase timeline. DRS cannot distribute the funds until the employer has notified DRS of the separation of the customer, which will not take place until sometime after the customer has received their last paycheck from the employer. For TRS and SERS members who separate or retire in the summer, this means that annuity payments will not start before September and likely won’t begin until November.

What is the fastest way to purchase the TAP Annuity?

There are a few actions you can take to ensure your annuity purchase goes smoothly.

Transfer your funds into the WSIB TAP investment program prior to making your TAP Annuity purchase. Transfer your funds online or contact the record keeper to start the transfer so you don’t have to wait until you stop working.

Complete your TAP Annuity purchase request online through your Plan 3 account. Ensure that the DRS record keeper has all necessary information before the third to last business day of the month.

Check in with your payroll office to know when they will be sending your separation date to DRS. If DRS receives this information after the third to last business day of the month, it will delay the purchase cycle another month.

Why is the WSIB TAP fund calculated monthly?

The fund contains slower moving assets, such as real estate. These assets increase the total diversity of the fund, but it takes more time to assess the value.

See a live or recorded annuity option webinar.

Investments

Plan 3 customers have investment accounts you fund with a percentage of your income.

We offer two types of funds: One-step or build and monitor. All funds are managed by the Washington State Investment Board.

One-step: These investments are automatically adjusted for you based on your age. The One-Step Investing approach includes Retirement Strategy Funds, also called age-based or target date funds. Because most customers choose one-step investing, this is also the default investment type for customers who do not select investments.

Plan 3 also includes a fund called the WSIB TAP or Total Allocation Portfolio. This is also a one-step investment program. However, this fund is not adjusted based on your age, but is managed in the same way the state pension fund is invested. If you select this option, all your new contributions will be invested in this fund.

Build and monitor: This is the DIY approach to investing where you choose from a selection of investments and create your own mix from a list of funds.

Investments and fees

Select the funds below to view their fact sheets. Funds for each table are listed in order of risk (lowest to highest). View the latest performance for all funds through your online account. The management fees associated with each fund are included here. These costs are in addition to the administrative fees detailed in the table lower in this section.

Retirement Strategy Funds (Fees as of July 2024)

| Funds | Manager fee |

|---|---|

| Retirement Maturity Strategy Fund | 0.1581% |

| 2015 Retirement Strategy Fund | 0.1618% |

| 2020 Retirement Strategy Fund | 0.1674% |

| 2025 Retirement Strategy Fund | 0.1758% |

| 2030 Retirement Strategy Fund | 0.1927% |

| 2035 Retirement Strategy Fund | 0.2073% |

| 2040 Retirement Strategy Fund | 0.2129% |

| 2045 Retirement Strategy Fund | 0.2059% |

| 2050 Retirement Strategy Fund | 0.1904% |

| 2055 Retirement Strategy Fund | 0.1904% |

| 2060 Retirement Strategy Fund | 0.1904% |

| 2065 Retirement Strategy Fund | 0.1904% |

| 2070 Retirement Strategy Fund | 0.1904% |

Build and monitor funds (Fees as of July 2024)

| Funds | Fund fee |

|---|---|

| Short-Term Investment Fund | 0.0806% |

| Washington State Bond Fund | 0.0069% |

| Socially Responsible Equity Investment | 0.4250% |

| US Large Cap Equity Index Fund | 0.0009% |

| Global Equity Index Fund | 0.0349% |

| US Small Cap Value Equity Index Fund | 0.0168% |

| Emerging Market Equity Index Fund | 0.0899% |

WSIB Investment Program

| Funds | Fund fee |

|---|---|

| Total Allocation Portfolio (TAP) | 0.5162% |

Funds are classified into two investment programs: Self-Directed and WSIB. Only the WSIB TAP fund is part of the WSIB investment program. The classifications are important for Plan 3 members when it comes to withdrawing your funds. Self-Directed fund values are calculated daily, whereas the WSIB TAP fund is calculated monthly. Plan 3 customers can transfer balances between the two investment programs. See when do you get paid for more information about timelines.

Investment performance

Compare the most recent performance for your Plan 3 investments through your online account. You can also access a quarterly overview of fund performance in the table links that follow.

Administrative fees (as of July 2024)

| Fee Type | Percentage |

|---|---|

| WSIB fee | 0.0174% |

| Recordkeeping fee | 0.0740% |

Investments have two types of costs. The management cost for the individual investment and the administrative costs applied to all plan investments. This table includes the administrative costs in addition to your fund fee in the previous tables. Find out more about investment costs in this video or in the investment faq section.

Managing your investments

Make investment changes through your online account. Change your fund selections anytime during or after your employment. You can also contact the record keeper for assistance. To change the investment program for future contributions, complete this form and give it to your employer.

Trading restrictions:

To safeguard customers against the effects of excessive trading, DRS has established trading restrictions that regulate how frequently you can change investments.

If you are transferring more than $1,000 out of a fund, you are required to wait 30 calendar days before transferring money back into that same fund. The 30-day window is based on the last time you made a transfer out of the fund. The restriction will not affect your regular contribution or the ability to leave state service and withdraw your money. Transfers of $1,000 or less are not impacted by the trading restrictions.

DRS periodically reviews trade data to identify excessive trading. If existing restrictions are not sufficiently addressing excessive trade practices, DRS might take additional action. DRS reserves the right to establish or revise restrictions to comply with federal or state regulations, or as circumstances indicate.

In addition to the trading restrictions described above, DRS will also comply with restrictions put in place by our fund managers.

Note: Excessive trading (also referred to as “market timing”) involves transferring significant amounts of money and/or making frequent trades between investment options. This practice requires more cash on hand to honor the frequent trades and transfers. Because the excess cash is used to cover potential transfers instead of being invested, long-term returns can be lowered for other participants. Excessive trading can also increase fund management costs.

Investment FAQ

Can DRS tell me what to invest in?

No. While DRS and the Plan 3 record keeper can provide information about investments, we cannot offer investment advice. Find out more about each fund by reviewing the fact sheet linked to the fund name in the investments and fees section. These fact sheets are prepared by the fund managers and contain information about performance, asset mixes and the goals of the fund. If you aren’t sure which investment approach might be right for you, talk with your financial advisor.

How do I choose a one-step Retirement Strategy Fund?

Take your birth year and add the age you expect to retire. That gives you a target year. Then you pick the fund with the date closest to that year.

Example: If you were born in 1993 and want to retire at 65 → 1993 + 65 = 2058 → pick the 2060 fund.

Are there fees with Plan 3 investments?

Yes, but they’re pretty low. Even though investment fees are often small (fractions of a percent), they do add up over time. It’s good to know the cost differences when you compare investment options as well. Plan 3 has two types of fees:

1. Administrative Fees

These cover fund costs like recordkeeping, communications, customer service, and oversight by the Washington State Investment Board (WSIB).

- The total WSIB and recordkeeping admin cost for Plan 3 is 0.0914% per year.

- It’s built into the share price, so you won’t see it listed on your statement.

- This fee is reviewed annually and may change each July.

2. Management Fees

These are what you pay the professionals who manage the funds. Review the management fees within the fund fact sheets linked in the investments and fees section.

You can switch your investment choices at any time, and it’s smart to check the management fee before making changes.

The amount varies depending on the fund you choose.

Like admin fees, these are included in the share price and not shown on your statement.

Example of fees applied to a $10,000 balance

Let’s say you have $10,000 in the 2035 Retirement Strategy Fund. Here’s how the annual fee breaks down:

• 0.2073% (Fund manager fee)

• 0.0174% (WSIB admin fee)

• 0.0740% (Recordkeeping admin fee)

• Total: 0.2987%

So, $10,000 x 0.002987 = $29.87 per year in fees.

How do I move money between the WSIB TAP and the Self-Directed funds?

You can move existing investment account funds to or from Self-Directed or WSIB. To move all or a portion of these funds, contact the DRS record keeper. The TAP Fund is valued only once a month and the transfer of funds can take up to 45-90 days to complete.

To change your future payroll contributions to or from Self-Directed or WSIB, complete this form and give it to your employer.

What is fund risk, performance and diversification?

Here’s the quick rundown:

Risk: All investments carry some risk. Generally, younger folks can handle more risk (more growth potential), while people nearing retirement often choose safer options. How much risk you take is really up to you.

Performance: Past returns aren’t a promise for future ones, but they can show how the fund tends to behave.

Diversification means spreading your money around, like not putting all your eggs in one basket. That way, if one investment drops, others might balance it out.

- If you go with a Retirement Strategy Fund (the “One-Step” option), it’s already diversified and will adjust automatically as you get closer to retirement.

- If you want more control (the “Build and Monitor” route), you can mix and match between different funds.

Can I invest in funds that aren’t listed here?

No. DRS does not offer a brokerage account option, and you must select from the lineup available. Each fund typically includes a mix of investments, such as stocks from various companies. You can review the fact sheets in the available investments section to see a summary of what’s included in each option.

All investment options for DRS plans are selected by the Washington State Investment Board (WSIB). If there are funds you would like to see, you can submit public comment to WSIB.

Where can I get more information about investing?

Investment fee comparison

Compare how investment fees can impact your account using this calculator.

Investment basics webinar

This DRS recorded webinar explores the investment options available to DCP and Plan 3 customers.

Financial Literacy and Education Commission

MyMoney.gov promotes financial literacy and education. Find out how to plan for life events with financial impacts, such as birth or adoption of a child, home ownership or retirement.

U.S. Securities and Exchange Commission (SEC)

The SEC provides investment regulation and education.

Washington State Department of Financial Institutions (DFI)

DFI provides regulatory oversight for our state’s financial service providers.

Washington State Investment Board (WSIB)

WSIB closely monitors the performance of all DCP investment options.

Required minimum distribution

What is a required minimum distribution (RMD)?

If you are a Plan 3 customer who is separated or retired, you must withdraw a minimum amount from your retirement investment accounts every year starting when you reach age 73. This minimum distribution of funds is required by federal income tax regulations. DRS calculates and pays out the minimum amount to you each year. This is to help you avoid the 25% tax penalty the IRS can impose if the minimum is not withdrawn.

The payments are automatically distributed to you, so no actions are needed for you to meet the requirements. But you can also choose to make adjustments to the distribution, such as the frequency of payments. Here is the form you need:

If you have investment funds in both the Self-Directed and the WSIB programs, your minimum payment will be withdrawn from your WSIB investment program account first. By completing the Plan 3 RMD form yourself, you can choose to have the money withdrawn differently.

Note: The SECURE Act has raised the RMD age from 70 ½ to 73 for most retirees. Age 73 applies to any member who has separated from service and was born on or after January 1, 1951. If you were born before July 1, 1949, then you must commence your retirement benefit at the later of age 70 ½ or when you separate from service. If you were born after June 30, 1949 but before January 1, 1951, then you must commence your retirement benefit at the later of age 72 or when you separate from service.

How is the minimum payment calculated?

You can calculate your required minimum distribution by taking the previous year’s Dec. 31 investment account balance and dividing it by the IRS distribution period based on your age. If you are a member of Plan 3 and DCP, you have two investment accounts that are subject to minimum distribution requirements and you calculate these separately.

To calculate your own RMD withdrawal, use the table linked below. Find your age in the table. The distribution period is the number you divide your total investment account balance by to get the required minimum amount.

IRS distribution period for your age

See the IRS distribution period for your age.

This table applies to you if your status is:

- Unmarried

- Married with spouse who is not more than 10 years younger

- Married with spouse who is not the sole beneficiary of your account

Example of an RMD calculation:

Alex is age 75 with a Plan 3 account balance of $150,000 as of December 31, 2018. To find the required minimum distribution (RMD) amount, Alex takes the account balance and divides it by the distribution period based on age 75, which is 22.9 years.

$150,000 / 22.9 years = an RMD of $6,550.00 for 2019.

If Alex is also a member of DCP, the same calculation will need to be performed on the DCP investment account balance.

When is it due?

DRS must issue your minimum payment by Dec. 31 to meet IRS requirements. You’ll usually receive your payment earlier in December. DRS will send you 1-2 reminder letters in the year you turn age 73 so you’ll know the RMD is coming. In the years after age 73, these payments will be automatic. You can change the frequency and amount of payment anytime by completing a Plan 3 withdrawal. Your withdrawal amount must at least meet the required annual minimum.

How do the requirements apply to a surviving spouse or beneficiary?

If the original account holder dies, the required minimum distribution is still required for beneficiaries of the account. Here’s how these requirements work:

A spousal beneficiary will be required to continue receiving RMD payments if the account owner had already met the required age. If the account owner had not reached the required age prior to death, the spousal beneficiary will be required to start their RMD payments in the year in which the account owner would have turned age 73.

For non-spousal beneficiaries, the RMD is calculated based on the beneficiary’s life expectancy in the calendar year immediately following the account owner’s date of death. DRS will process an RMD payment if the account owner had turned age 73 or older. If the account also has rollover requests, the RMD will be processed before these.

What if I’m still employed?

If you are still employed by the same DRS-covered employer, the minimum distribution requirement does not apply to you. If you separate from your Plan 3 covered employment and you are age 73 or older, the RMD will apply.

More information

To find out more, contact the DRS record keeper at 888-327-5596 or visit the RMD section of the IRS website.

This information about required minimum distributions is a summary. For a complete description of RMD rules and information, see Required Minimum Distributions on the IRS website. If a conflict exists between the information on this page and what is contained in current law, the law governs. Please talk with your financial advisor if you have questions about taxes on your investment funds. DRS team members aren’t able to give tax advice.

Life events that can affect your pension

Death

Death of a retired member

Please contact DRS as soon as possible. If the retiree chose a survivor benefit, we must update the account for payments to continue. If the retiree did not select a survivor option, we need to stop monthly benefits to avoid an overpayment.

When you contact us, please be ready to provide the deceased retiree’s:

- Full name

- Social Security number

- Date of death

We’ll also ask who is handling the affairs for the estate.

Report a death to DRS

Online: Report the death online.

Phone: 360-664-7081, Option 1

Email: drs.moddnd@drs.wa.gov – Please provide only the last 4 digits of the deceased’s SSN

Mailed form: Print and mail this death reporting form to DRS.

Death of an active or not yet retired member

If the deceased worked in a public service position in Washington, payment may be due to survivor(s). When you contact us, please be ready to provide the deceased member’s full name, Social Security number and date of death. Also tell us if the death may be work-related.

Death of a beneficiary or survivor

If you are an active member, you can update your beneficiary designation at any time by logging into your online account.

If your named survivor dies after you retire, you can have your pension benefit changed to the single-life option with no survivor reduction. You will need to report the death to DRS. This provision applies to all DRS plans except for LEOFF and WSPRS Plan 1, which have different survivorship options.

Disability

If you become totally incapacitated and leave your job as a result, you might be eligible for a disability retirement benefit. The disability retirement was originally created for customers who wouldn’t otherwise be eligible to start receiving a retirement benefit. Even if you have not yet reached the minimum age for retirement, or you are not yet vested in your plan, you can still apply for a disability retirement.

Do you already qualify for retirement?

If you are vested in your plan and qualify to retire, there is no financial benefit to taking disability vs retirement, even for early retirement. The income you receive for either retirement uses the same calculations. Early or full retirement is also a much faster process than disability retirement.

How to apply for a disability retirement

Call DRS and request an official estimate for a disability retirement. It takes about 3-4 weeks for DRS to calculate your benefit. Then we will mail you a packet with the estimate and a three-part form. You, your employer and your doctor will need to complete all three forms in the packet.

Once DRS receives the completed application and all supporting documentation, it usually takes about four to six weeks to determine your eligibility for a disability retirement.

The full application process averages 4-5 months from the time you request the estimate, but the timing can vary. Providing all requested documentation along with a complete application can help reduce the wait time.

If the disability retirement is approved, your retirement date would be the first of the month after your separation date. DRS would issue your monthly benefit payments on the last business day of the following month and every month after.

Returning to Public Service

Returning

If you leave your position, withdraw your contributions and later return to PERS work, you can restore your Plan 3 contributions at any time unless you waived your pension benefit.

A dual member, or someone who belongs to more than one retirement system, might be able to restore service credit earned in a retirement system other than PERS. Each time you become a dual member, you’ll have 24 months to restore service credit earned in a previous retirement system. It might still be possible to purchase service credit after the deadline has passed. However, the cost in that case is considerably higher.

To explore financial projections and comparisons of your estimated retirement benefits, try using the Plan Choice Calculator.

Retired? See working after retirement.

Missing or withdrawn service credit

Missing or withdrawn service credit

Service credit is the time used to calculate your pension retirement income. Sometimes customers notice their service credit doesn’t match their seniority date—these times do not always match. Often, the difference is because of missing or withdrawn service credit. You may be eligible to purchase some or all of the missing credit. Here is what you need to know about the process.

How do I check my service credit?

View your complete service credit history through your online account. It is a good practice to check your service credit every few years to be sure it matches your expectations.

Contact DRS for a cost estimate

You will need to contact DRS to request a cost for restoring your credit. We are not able to provide an estimate when you call. Similar to a retirement benefit estimate, this cost must be calculated by DRS and may require information from your employer.

You’ll need this information

The following preparation can expedite your request:

Provide the dates for the missing service. Find your service credit history in your online account.

Let us know if there is a gap in your service credit or if you withdrew from your account.

- If there is a gap in your service credit, do you know why? Were there any special circumstances around your employment at the time? Some common events for missing credit include: authorized leave of absence, childbirth, substitute teaching, temporary duty disability, or injury.

- If you withdrew from your account, when did you pull out the contributions?

How do I pay?

Make direct payment with either a personal or cashier’s check. Or in many cases it’s also possible to transfer funds from another eligible retirement account to purchase service credit. However, DRS cannot accept funds in excess of the cost to make your purchase. Check with your account administrator to see if you can transfer those dollars to a 401(a) account type.

There is a deadline

You must request and purchase the missing service within the timeframe allowed for your plan. The amount of time varies by plan. Ask DRS about your options for purchase. If the deadline has passed, you may still have the option to purchase additional service credit as an annuity option when you retire. This purchase will not restore missing time, but it would be used in your retirement payment calculation.

Retired members

The retiree resources page includes the following:

- Annual COLA updates

- Pension payment schedule

- How to get a proof of income letter

- And more

Working after retirement

How will your retirement income be affected if you return to work? It depends on where you work and how many hours.

You fully separate from employment

You must separate from employment. This means you must wait at least 30 consecutive days after your effective retirement date before returning to work and not have any pre-arranged agreement to return to work before retiring. If you return to work for a DRS-covered employer in any capacity before 30 days have passed, your benefit will be reduced.

If you return to work for a DRS-covered employer before your effective retirement date, your retirement application will be cancelled and you will continue to make member contributions.

How many hours are you working?

If you’re going to work less than 867 hours in a calendar year, your benefit won’t be affected. If you return to work for an employer covered by one of the state retirement systems in a DRS eligible position, your benefit could be affected if you work more than 867 hours per year. Your employer can tell you whether your position is eligible.

Working for a non-DRS covered employer

Unless you’ve been approved for a disability retirement, you can return to work for an employer not covered by a Washington state retirement system without affecting your monthly benefit.

Exceptions

Exceptions for nursing positions and school districts

New state laws allow some retirees to return to work up to 1,040 hours without affecting pension benefits. See the new exceptions.

See a live or recorded working after retirement webinar.

Members of more than one retirement plan

If you are a member of more than one Washington state retirement system, you are a dual member. You can combine service credit earned in all dual member systems to become eligible for retirement. However, your retirement benefit will be calculated using only the service credit earned in each system.

In most cases, your monthly benefit will be based on the highest base salary you earned, regardless of which system you earned it in. Base salary includes your wages and overtime and can include other cash payments if those payments are included as base salary in all the retirement systems you are retiring from.

Example

If you retire at age 65 with three years of service credit from TRS Plan 3 and four from the Public Employees’ Retirement System (PERS) Plan 3, you are a dual member. Without dual membership, your service wouldn’t be eligible for a monthly benefit from either system. With dual membership, your service credit is combined, giving you enough to retire. Your benefit from each system is calculated with service from that system alone. This is how your benefit is calculated:

1% x 3 (TRS service credit years) x Average Final Compensation (AFC) = TRS benefit

1% x 4 (PERS service credit years) x AFC = PERS benefit

TRS benefit + PERS benefit = total monthly benefit

See the multiple plans page for more information about dual membership.

See a live or recorded membership in multiple plans webinar.

Military service

Do you have U.S. military service? If you leave or reduce your DRS retirement plan-covered employment to serve in the military, you could be eligible for restoration of missing retirement service credit. The amount of service credit you have directly affects your retirement income calculation.

There is a deadline

You must complete payment for the military service credit within five years of returning to DRS-covered employment, or before you retire, whichever comes first. After this time has passed, and if the service does not qualify for no-cost service, you will no longer be eligible to replace the service credit using the military credit program. However, you can still purchase the service credit for a much higher cost as an optional bill past the statutory deadline date up to the time you retire (RCW 41.50.165). The longer you wait, the more it costs.

How much will it cost?

You can apply to recover up to five years of interruptive military service credit (sometimes up to 10 years depending on your circumstance). If your military service was during a period of war or an armed conflict during which you earned a campaign badge or medal, you might be able to recover up to five years of service credit at no cost to you.

For other interruptive military service, you can apply to receive an optional bill for the retirement contributions you would have paid on your normal salary during that time. However, you must pay your optional bill within five years after you return to work, and you must be working for the same employer you left to serve in the military. If you don’t pay the bill within five years, you might still be able to purchase the service credit, but at a much higher cost.

How do I apply?

Contact DRS about a month and a half after you return to work to ask about recovering military service credit. You will then submit information, such as a copy of your DD214 service record, to help us determine your eligibility. DRS will review your account as well as the information you provide and notify you of our findings, including an optional bill if applicable. This usually takes 2-3 weeks.

Other ways to increase your retirement

Depending on the type of funds you have available, DRS has a couple of annuity purchase options to increase your monthly pension amount.

Marriage or divorce

Your retirement account can be affected by changes in your marital status. If you marry or divorce before you retire, you need to update your beneficiary, even if your beneficiary remains the same.

Marriage

If you are married when you retire, you choose from a few benefit options that can include retirement income coverage for your spouse if you die before them.

If you marry after retirement, you could be eligible to change your benefit option to add your spouse. You need to be married at least a year and request DRS add your spouse during your second year of marriage.

If you become widowed after retiring, you can have your benefit option changed to the single-life option with no survivor reduction. You will need to report the death to DRS.

See more about changing your survivor after retirement.

Contact DRS for more information.

Divorce or separation

Upon divorce or separation, your monthly benefit is not subject to sharing or division unless it is court-ordered. DRS could be required to pay a portion of your retirement account to satisfy a divorce agreement. This order is called a property division. The order could award an interest in your account to your ex-spouse, or split your account into two separate accounts.

For questions about a property division, or to start the process, contact DRS.

For further research on property orders, see WAC 415-02-500.

IRS federal taxes or limits on your benefit

Federal taxes on your benefit

Most, if not all, of your benefit will be subject to federal income tax. The only exception will be any portion that was taxed before it was contributed. When you retire, we will let you know if any portion of your contributions has already been taxed.

Since most public employers deduct contributions before taxes, it’s likely your entire retirement benefit will be taxable.

At retirement, you must complete and submit an IRS W-4P form to let us know how much of your benefit should be withheld for taxes. If you don’t, DRS is required to withhold federal taxes as if you are single with no adjustments. To adjust your IRS tax withholding amount after retirement, log in to your online account or mail a new W-4P form to DRS.

For each tax year you receive a retirement benefit, we will provide you with a 1099-R form to use in preparing your tax return (see 1099-R). These forms are usually mailed at the end of January for the previous year. The information is also available through your online account.

It is your responsibility to declare the proper amount of taxable income on your income tax return.

If you opt to deduct health care from your monthly pension payments in retirement:

The IRS considers health insurance premiums paid via your monthly pension as part of your taxable income. This is because your pension contributions were not taxed (see IRS page 8). Visit the retired member page for more information about deductions in retirement.

Federal benefit limits for high income members

If you are a highly paid member or retiree, you may encounter a federal limit on your retirement benefit. There are two federal regulations that could limit benefits for highly paid members and retirees. The salary limit (which restricts the salary used to determine your benefit) and the benefit limit (which limits the annual benefit amount you can receive). In other words, federal law limits the amount of compensation you can pay retirement system contributions on, and that can be used in your benefit calculations. The IRS can adjust the amount each year.

2025 salary limit

The 2025 limit is $350,000. This means any salary you earn over this amount in 2025 will not be part of your retirement contributions or your pension calculation. See the following section for more information on how this limit applies to you.

Internal Revenue Salary Limit for Active Members

If you began public service before 1/1/96

- You don’t have a salary limit

- You pay contributions on all salary earned

- DRS does not adjust your Average Final Compensation for limit testing purposes

- Your pension calculation is not affected by salary limits

- IRC section 415(b) requires that your annual benefit must not exceed the limit. If you don’t exceed the benefit limit at the time you retire, it is still possible that your benefit may be affected at a later date.

If you began public service on or after 1/1/96

- The current year salary limit applies (see above)

- The salary limit is the same for all members and is adjusted annually by the IRS

- If you reach the salary limit in a calendar year, you stop paying contributions

- DRS notifies your employer when you approach the salary limit

- Your Annual Final Compensation is capped for limit testing purposes if it includes the years you exceeded the salary limit

- Your pension calculation is affected by salary limits

How do survivors or beneficiaries impact the limit?

Does my benefit amount change for my survivor beneficiary after I die?

No. If you chose to provide for a survivor beneficiary, and you die before your survivor does, your benefit transitions to your survivor at the rate you chose (100%, 50% or 67%). After the transition, your survivor’s benefit will also be tested.

What happens if my survivor beneficiary dies before I do?

If your survivor beneficiary dies before you do, your benefit increases as if you hadn’t chosen a survivor option. If your survivor beneficiary was your spouse or domestic partner, we will continue to use your original benefit amount in your annual testing. If your survivor beneficiary was not your spouse or domestic partner, we will use your new, higher limit amount in your annual testing.

More information about federal limits

The IRS characterizes the retirement systems as 401(a) defined benefit plans. To retain status as qualified plans, the systems must comply with federal regulations. For more information about salary limit regulations, see Internal Revenue Code (IRC) Section 401(a)(17). For more about benefit limit regulations, see IRC 415(b).

For more information see these IRS resources:

More about PERS Plan 3

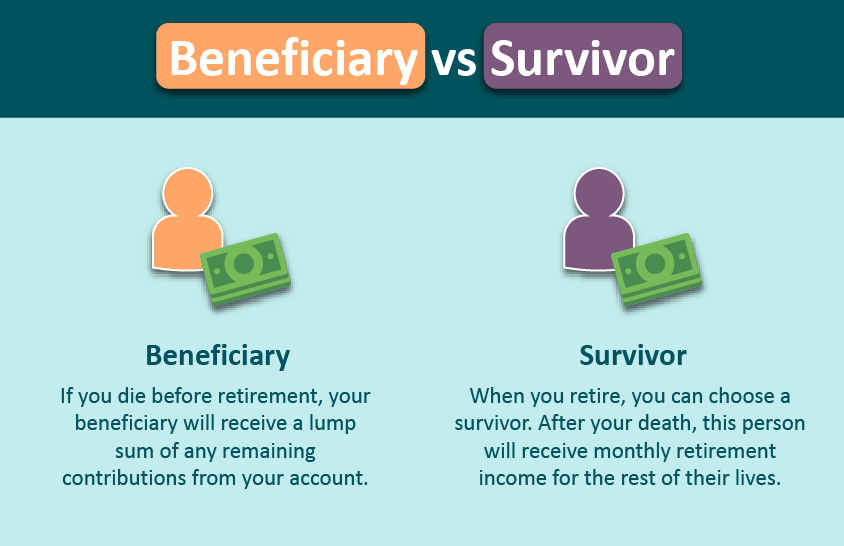

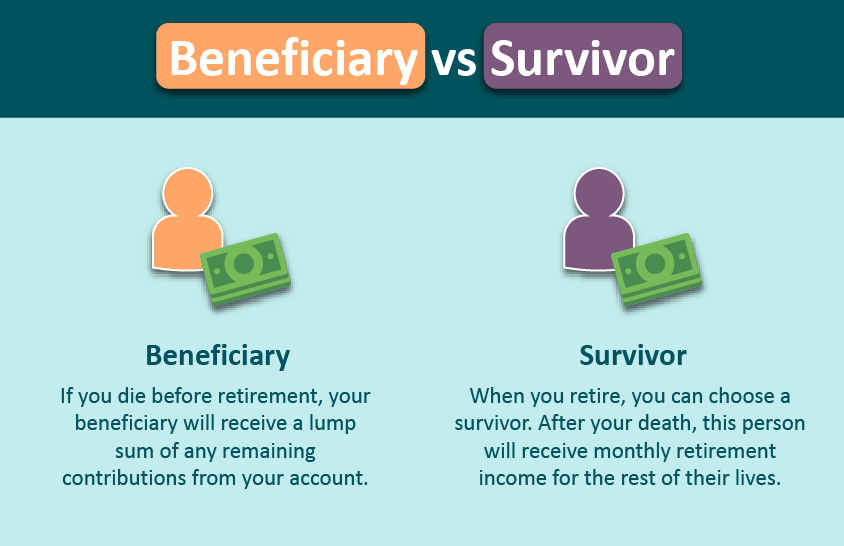

Selecting a beneficiary

The beneficiary information you give DRS tells us the person(s) you want to receive your remaining benefit, if any, after your death. Submit or update your beneficiary information at any time before retirement using your online account. Or you can submit a paper beneficiary form.

If you don’t submit this information, any benefits due will be paid to your surviving spouse or minor child. If you don’t have a surviving spouse or minor child, we will pay your estate.

Be sure to review your beneficiary designation periodically and update it in your online retirement account if you need to make a change. If you marry, divorce or have another significant change in your life, be sure to update your beneficiary designation because these life events might invalidate your previous choices.

State-registered domestic partners have the same survivor and death benefits as married spouses. Contact the Secretary of State’s Office if you have questions about domestic partnerships.

Visit the beneficiary page for more information.

Your survivor benefit options

When you apply for retirement, you will choose one of the four benefit options shown below. If you choose a survivor benefit option, you must send a copy of a proof-of-age document, such as driver license or passport, when you apply for retirement. Once you retire, you can change your option only under limited circumstances.

Option 1: Single Life